In Taipei, real estate agent Jason Sung is betting that house prices around a high-tech industrial park in the northern part of the Taiwanese capital will soon skyrocket — thanks to the computer chip maker. Nvidia.

The place where Nvidia plans to build its new Taiwan headquarters as it rapidly expands on the island, destined to excel Apple to become the largest customer of Taiwan semiconductor maker TSMC, the largest contract manufacturer of advanced chips needed for artificial intelligence.

Nvidia CEO Jensen Huang described Taiwan as “the center of the world’s computing ecosystem.” It is riding high on the global AI frenzy. Its economy grew by a 8.6% annual rate last year, and it hopes to maintain that momentum after it recently sealed a trade deals with US President Donald Trump cutting US tariffs on Taiwan to 15% from 20%.

“We were lucky,” said Wu Tsong-min, an emeritus economics professor at National Taiwan University and a former board member of Taiwan’s central bank.

But Taiwan’s heavy reliance on computer chip makers and other technology companies carries a growing risk of AI madness turning into a bubble.

“What if the AI bubble is real, and what if the rapid development slows down, what’s next for Taiwan? That’s the question many are asking,” said Wu.

Growing tension with Beijing, which claims to independently govern Taiwan as a territory of mainland China, another ongoing threat, despite the island’s important role in global chip and AI supply chains.

Taiwan leads in chipmaking

An island of about 23 million people, Taiwan is highly dependent on exports. They jump nearly 35% year-over-year by 2025, as US shipments increase 78% due to increased AI demand.

That’s mostly thanks to TSMCor Semiconductor Manufacturing in Taiwan Corp., and electronics giant Foxconn, which makes AI servers for Nvidia and is a major supplier to Apple.

Taiwan has undergone major economic changes as it transitions from typically labor-intensive industries such as plastics and textiles to advanced manufacturing such as semiconductor fabrication.

The AI frenzy has made TSMC one of the top 10 most valuable companies in the world. Its profit jumped 46% last year to $1.7 trillion Taiwan dollars ($54 billion).

The chipmaker has invested heavily in Taiwan and the new factories in Arizona in the US It produces more than 90% of the world’s most advanced chips.

Foxconnformally known as Hon Hai Precision Industry Co., has doubled its value since 2023. The maker of Apple’s iPhone and iPads now produces AI servers and racks and has collaboration with OpenAI to supply AI data center equipment.

Taiwan’s heavy reliance on its technology industry means the biggest risk is that growth will “rely heavily on the AI boom and continuing the technology race,” said Lynn Song, chief Greater China economist at ING Bank.

Risks persist in an AI bubble?

Concerns that the AI craze may prove to be a foam prone to a bust similar to the dot.com crash in 2000 that swept through the markets, alarming many in Taiwan.

“I’m also nervous about it,” said CC Wei, the chairman of TSMC when asked about a potential AI bubble during an earnings call in January. “Because we need to invest about $52-$56 billion (this year).”

“If we don’t do it well, that would be a big disaster for TSMC for sure,” he said. “I want to make sure that the demands of my customers are real.”

In a recent report, analysts from Fitch Ratings argued that the demand for AI will remain strong even in the near term. In the longer term, however, the risks “will depend on the evolution of AI, as well as trade and investment policies and the adaptability of Taiwanese companies,” they wrote.

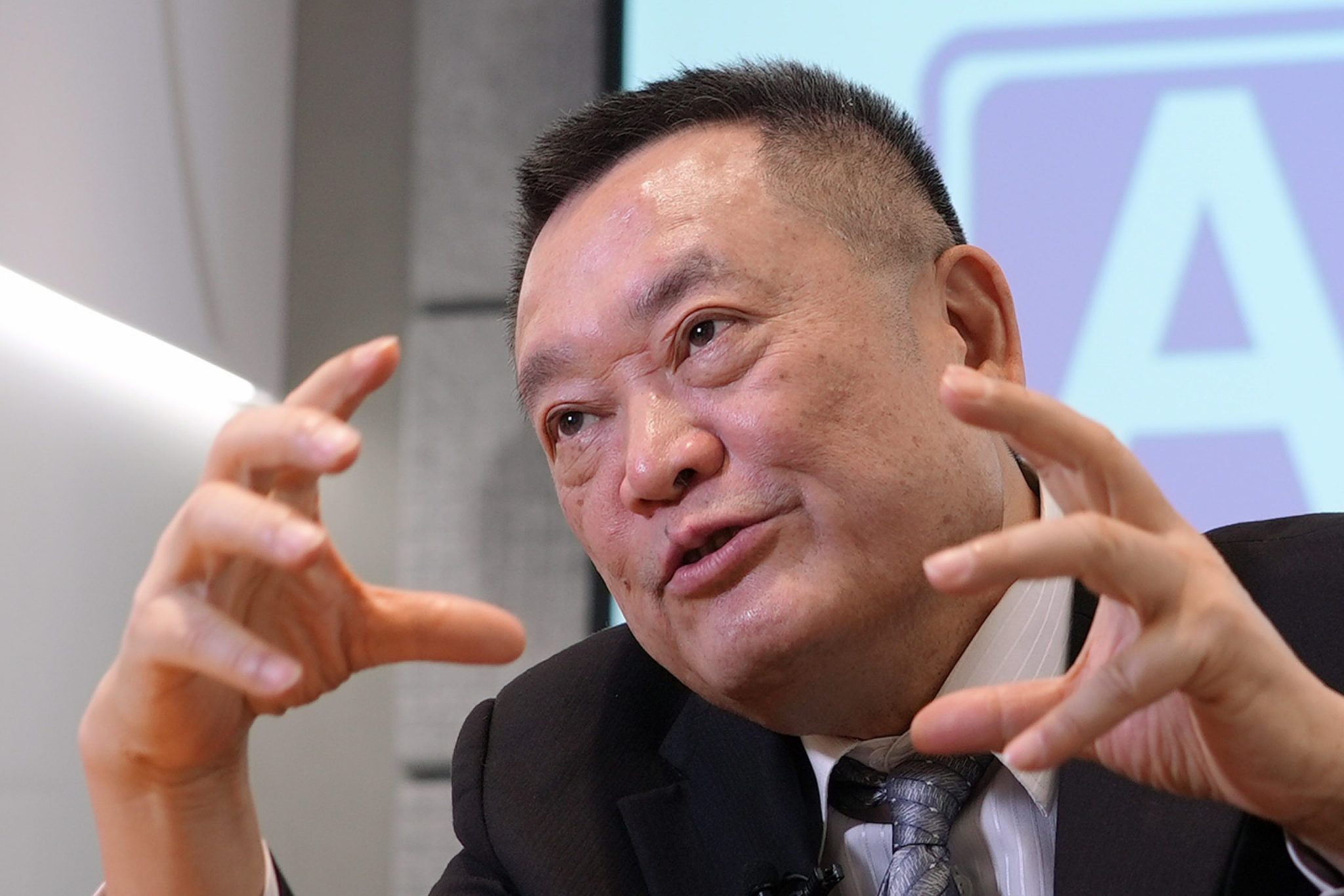

Taiwanese electronics company Asia Vital Components, a leading supplier of liquid cooling systems for Nvidia, has invested heavily in research and development. Its chairman, Spencer Shen, said he sees no signs of a slowdown in AI-related demand so far. The company has already designed thermal solutions for the 2028 AI servers, he said.

“We don’t believe it’s a bubble,” Shen told The Associated Press in an interview. “AI is driven by companies with real products and large cash flows, such as Amazon, Microsoft, Google and Meta.”

“In fact, AI infrastructure is still in short supply,” Shen added. “I expect AI to run down to our everyday level and change the way things work.”

Taiwan has a ‘silicon shield’ against Beijing

Some in Taiwan believe that its important role in the technology sector, especially as a manufacturer of computer chips whose main material is silicon, will help protect the island from attack by communist rule Beijing, whose leaders have vowed to reunite the island with mainland China, by force if necessary.

The two governments split in 1949 during the civil war. Beijing is making progress pressure, held military drills nearby. Exercises in late December included live rounds landing closer on the island than before, Taiwanese officials said.

Such geopolitical factors cloud the economic outlook, although many in Taiwan including former President Tsai Ing-wen believe its importance in global chipmaking will prevent China from attacking.

The risk of an invasion is unclear. Global tech companies and Chinese industries will suffer massive disruptions in the chip supply chain, said Wu of National Taiwan University.

However, some companies have identified contingency scenarios in recent years on how to respond in the event of Chinese military action, said Chen Shin-horng, vice president of the semi-official Chung-Hua Institution for Economic Research.

“We have to understand the potential danger, the potential damage to Taiwan,” Chen said.

While many of its core research and development activities are in Taiwan, TSMC already has plants in China, Japan and the US, and it is expanding its offshore production in the US, Germany and Japan.

Almost 65% of Foxconn’s manufacturing is in China, and the company has factories in other parts of the world such as India, Mexico and the US AVC is expanding production capacity in Vietnam.

While others call on Taiwan to diversify it eCONOMY away from technology to reduce risks, some argue that duplicating world-leading technology is the way forward. “This is our biggest strength,” Shen told AVC.

Some in Taiwan were abandoned

The AI boom has done wonders for Taiwan’s stock exchange, where the benchmark Taiex has risen nearly 250% over the past decade, making many investors rich. Economists have significantly upgraded forecasts for Taiwan’s economic growth for 2026 based on strong AI-related exports.

But as is true elsewhere, wealth is not evenly spread. Many residents of Taiwan feel abandoned.

Taiwan’s wealth gap, according to official data, has nearly quadrupled in the past three decades.

The wages of tech workers who have already earned high salaries have increased, especially chip engineers and managers. For other traditional industries, such as plastics and machine tool makers, growth has slowed.

Economists say the gap could widen as the AI trouble continues.

“It can be difficult to make a living,” said Jean Lin, a 30-year-old manager of a takeaway outlet that sells bento food in a Taipei neighborhood where Foxconn’s office is located.

“Many of the younger generation still can’t afford an apartment,” added Lin, who wants to start his own business in the future. “A lot of young people still feel like they don’t have a lot of money.”

___

Associated Press video journalist Johnson Lai contributed.