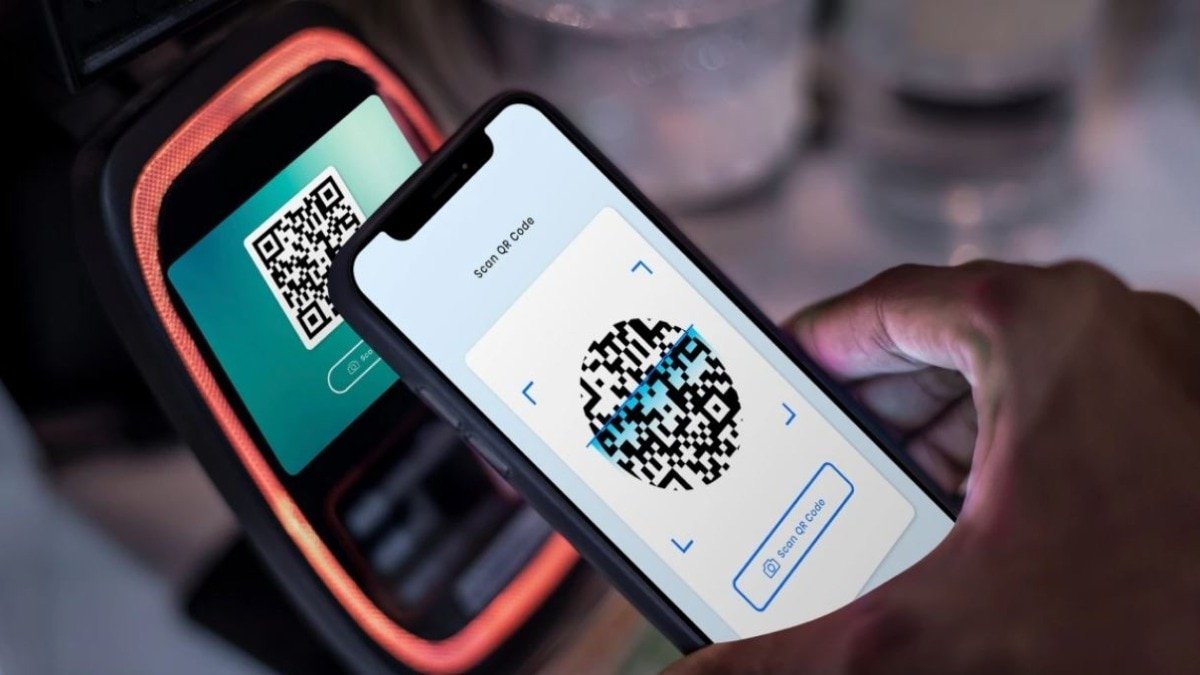

Travel between India and Malaysia will become easier for digital payments after NPCI International Payments Limited (NIPL) signed an agreement with Payments Network Malaysia Sdn Bhd (PayNet) to link India’s UPI with Malaysia’s DuitNow.

The partnership will allow Indian travelers to pay at local shops, restaurants and other merchants using UPI in Malaysia, just like they do at home and vice versa. Once the service is launched, Indian tourists will be able to pay at millions of DuitNow QR outlets across Malaysia.

Malaysian visitors to India will also have access to millions of UPI QR touch points across the country, making small daily payments smoother without the need to carry cash or exchange currency frequently.

Announcing the partnership, Ritesh Shukla, Managing Director and CEO, NPCI International, said, “Under the guidance of the Government of India and the Reserve Bank of India, we aim to expand UPI’s global footprint by building interoperable and real-time payment ecosystems with leading payment networks worldwide. Our partnership with PayNet marks an important step in enabling seamless cross-border collaboration between cross-border payments, security offering and India’s collaboration reinforces our commitment to simplify cross-border payments while strengthening digital and economic connectivity between the two countries.”

Praveen Rai, CEO of PayNet, said the deal would simplify everyday payments across borders for travelers and businesses. “This agreement reflects how the domestic payment infrastructure can support everyday cross-border payments at scale. Once enabled, the tie-up between Malaysia’s DuitNow QR and India’s UPI will strengthen payment connectivity for travelers, merchants, banks and the wider financial services ecosystem. Against the backdrop of Asia’s growing digital economy, close collaboration initiatives like this will further foster integration between markets.”

The companies said the collaboration will help build stronger payment links between India and Malaysia by making QR-based payments interoperable. Payments to merchants are expected to be more secure, efficient and seamless for travelers in both countries.

NPCI International Payments Limited (NIPL), incorporated on April 3, 2020, is a wholly owned subsidiary of National Payments Corporation of India (NPCI). It works to bring India’s UPI and QR-based payment technologies to global markets, helping to expand digital payments beyond India while supporting simpler and faster transactions.