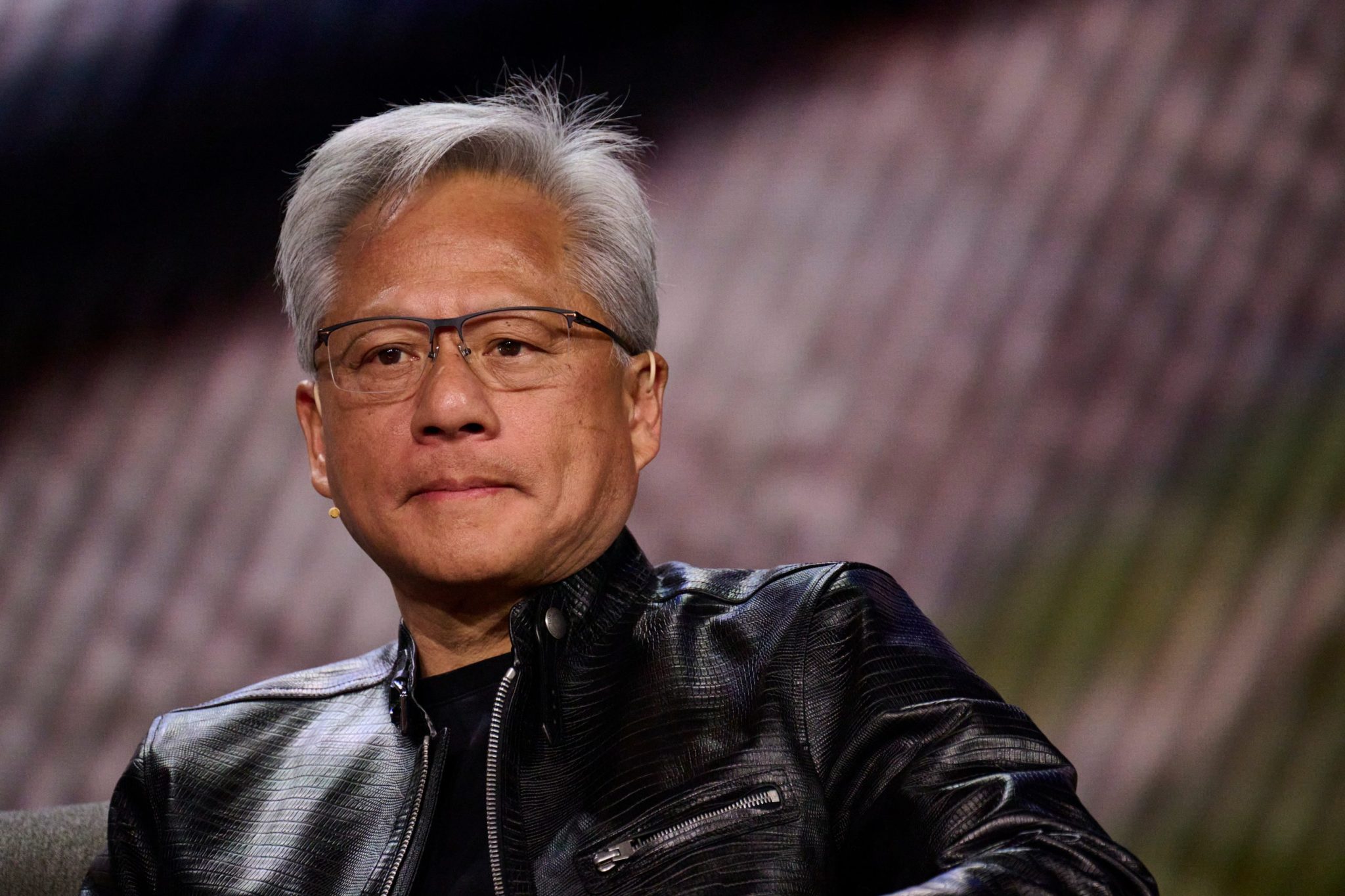

OpenAI may receive Nvidia’s largest investment, but the AI chip leader will not be set at $100 billion, according to CEO Jensen Huang.

While speaking to reporters over the weekend in Taiwan, he was asked about a Wall Street Journal report saying he doesn’t like OpenAI’s business approach and worries about the competition it faces Alphabet and Anthropic.

Sources also said the Journal that Nvidia’s plan to invest up to $100 billion in OpenAI has stalled and that Huang emphasized that the deal is not onerous. But he told reporters it was “absurd” to say he was unhappy with OpenAI. And while Huang acknowledged that the $100 billion “no commitment“Nvidia still plans to make a “big” investment and supports OpenAI CEO Sam Altman, who is reportedly looking to raise up to $100 billion in a round of fundraising.

“I believe in OpenAI. The work they’re doing is amazing—they’re one of the most important companies of our time, and I really like working with Sam,” he said. “Sam is closing the round, and we’re going to be fully involved. We’re going to invest a lot of money, probably the biggest investment we’ve ever made.”

Asked if it was $100 billion, Huang replied, “No, no, nothing like that,” adding that Altman will decide how much fundraising to announce.

In September, Nvidia signed a letter of intent for plans to invest up to $100 billion in OpenAI for new data centers and other AI infrastructure.

Such are the so-called hyperscalers of AI that pour hundreds of billions of dollars a year to rapidly expand their capabilities, covering large amounts of computing power, electricity, and water—not to mention all the land, construction materials, and labor to build large data centers.

At the same time, AI companies are investing in each other, raising fears of so-called circular spending that could obscure their true return on capital.

In fact, OpenAI bought Nvidia chips because it increased its computing capacity, in addition to receiving investments from the chip giant.

In another such deal that raised eyebrows, Nvidiarecentlyannounced plans to pour an additional $2 billion into cloud computing provider CoreWeave, which is also a buyer of Nvidia chips.

Meanwhile, OpenAI is reportedly in talks with other potential investors for its fundraising round that could value the company at more than $800 billion, including AmazonSoftBank, and leading Mideast investors, according to Bloomberg. It may also consider an IPO for later in 2026, the Wall Street Journal reported.

This story was originally featured on Fortune.com