So far at rise of artificial intelligence (AI).some of the biggest winners have not been AI software developers, but the hardware companies that produce the chips AI needs to function.

Nvidia (NASDAQ: NVDA) is the first example. Due to AI demand for its graphics processing units (GPUs), it has become the most valuable company on the planet with a valuation of $4.2 trillion. It even briefly broke above $5 trillion late last year.

Will AI create the world’s first billionaire? Our team has just published a report on the one little-known company, called “Indispensable Monopoly” that provides the critical technology that Nvidia and Intel need. Continue »

The company has already created an estimated 27,000 millionaires and is likely to mint a few more. But it also raises the question of who is next?

And I think I may have an answer for you.

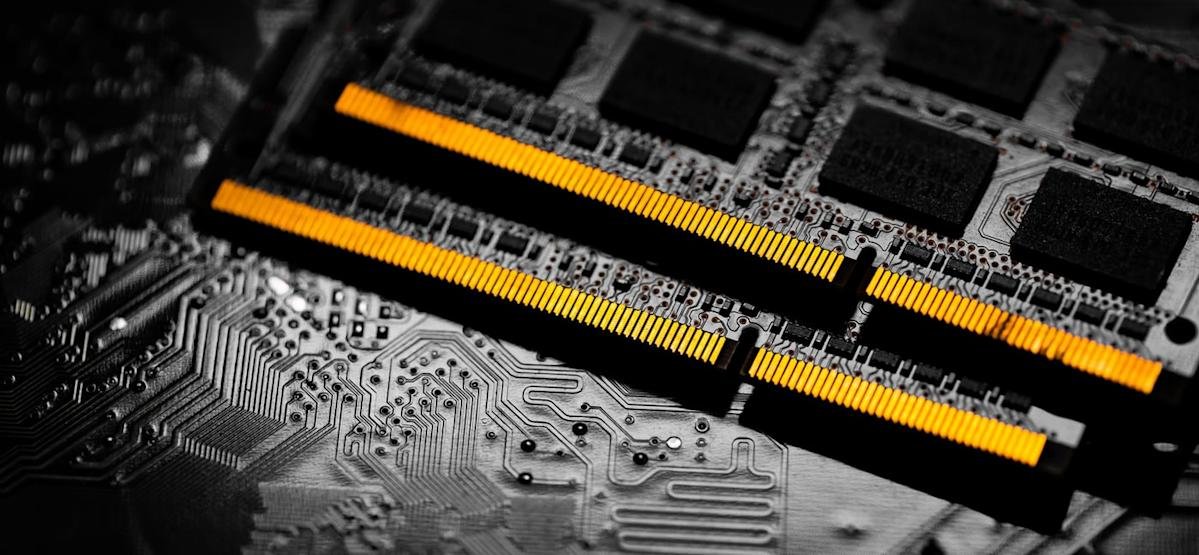

Based in Boise, Idaho, Micron technology (name: mu) primarily makes memory hardware, including random access memory (RAM) and dynamic random access memory (DRAM).

Computers rely on RAM chips to store and retrieve data. AI needs it for the same reason; it just needs a lot more than the 8-32 gigabytes or so most laptops have these days.

AI needs so much RAM, in fact, this tech hardware magazine Tom’s hardware project that data centers will consume 70% of all memory chips manufactured this year, creating a critical memory shortage.

The shortage has already caused the cost of smartphone memory to grow by 10% to 15% by 2026. And IntelCEO Lip-Bu Tan recently said the memory problem could continue for at least the next two years.

There will be a lot of money to be made producing memory in the second half of the 2020s. Micron has prepared to end its production of RAM for the consumer market and is starting construction on a gigantic factory near Syracuse, New York.

Micron has already seen its stock price rise more than 300% over the past 12 months because of this. Despite this, it still trades at a bargain valuation relative to its competitors.

Micron has been on a growth tear lately. For its entire 2025 fiscal year (ending August 28, 2025), it generated revenue of $37.4 billion, up 49% from the previous year. And for the full year it achieved a gross margin of 39%, an operating margin of 26% and a net income margin of 22.8%.

And, based on the company’s fiscal first quarter 2026 results (reported on December 17, 2025), that growth streak continues this year as well.

During the quarter, Micron reported revenue of $13.6 billion, up 57% from a year earlier. It grew its gross margin to 56.8%, its operating margin to 47% and its net income margin to 40%.