Warren Buffett’s failure to capitalize on the digital shift in the economy over the past two decades has tarnished his poor track record as an investor. His blind spot is about tech didn’t stop at the stock market: It bled into how he also ran Berkshire Hathaway’s operating companies. In many of his wholly-owned businesses, Buffett has neglected technology upgrades, and the value of Berkshire’s business has suffered as a result.

It is important to understand this because the majority of Berkshire Hathaway’s assets are invested not in publicly traded securities, but in operating subsidiaries such as the Burlington Northern Santa Fe Railroad, Berkshire Hathaway Energy, and Geico. While it’s true that Buffett has invested aggressively in wind power, that’s because of government tax incentives. Basically, he prefers to milk his operating subsidiaries for cash rather than reinvest them for the digital age. Exhibit A is Geico, which due to a lack of investment in IT went under Progressive as the nation’s leading for-profit auto insurer.

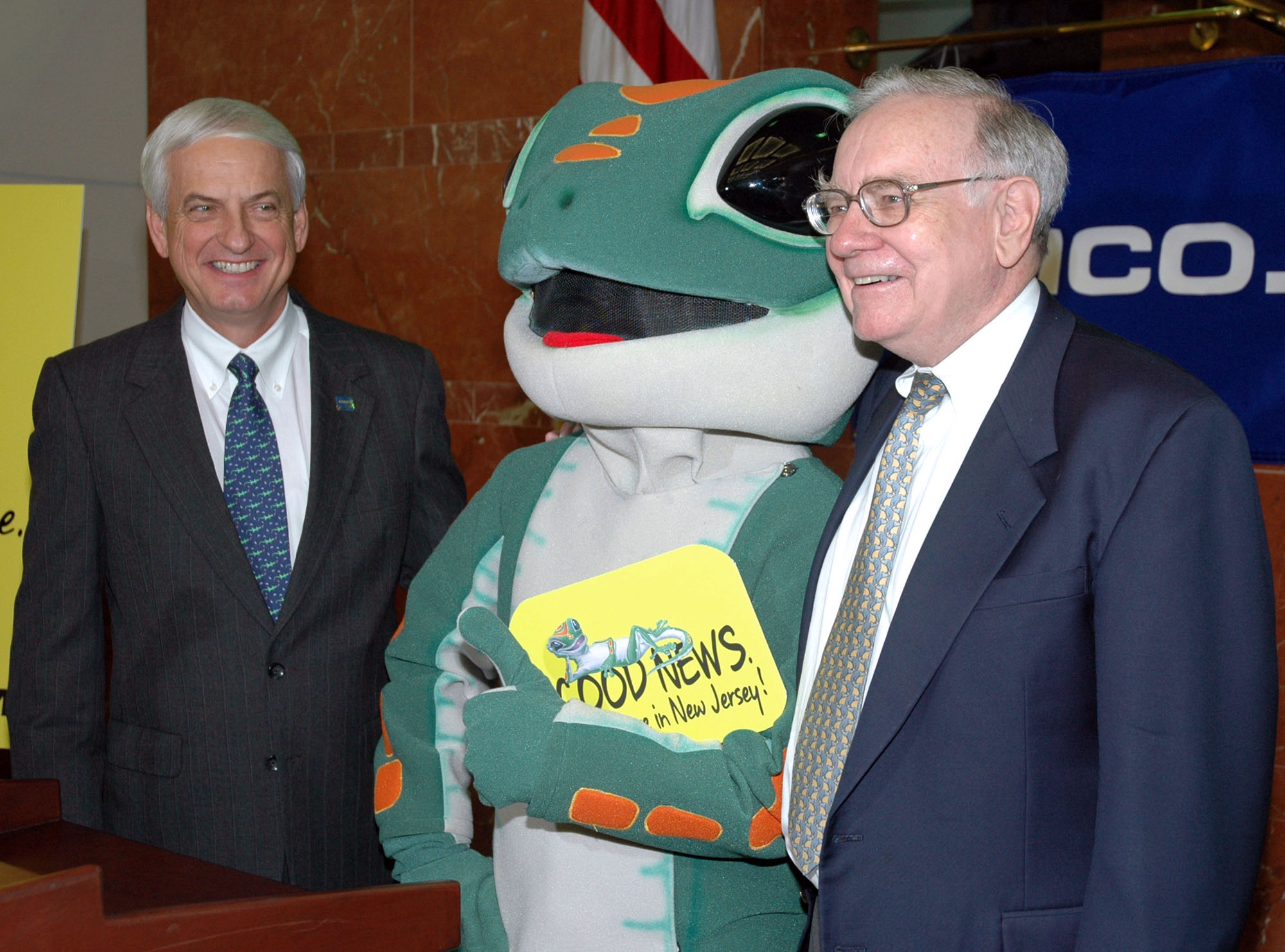

Buffett calls Geico his favorite son, and for good reason. Since it began in the 1930s, the auto insurer has used a direct-sales model to keep operating costs the lowest in the industry. In a commodity business like insurance, that’s a huge competitive advantage. In the 1990s, after he bought all of Geico, Buffett found a second moat when he began to brand Geico as a reliable, even beloved American company. The lizard, the caveman, the camel celebrating hump day—all of these are marketing masterstrokes, derived directly from Buffett’s deep understanding of the mass brand-mass media industrial complex. The mascots also highlight how, while Buffett is comfortable investing in marketing, he is less comfortable with, and therefore doesn’t understand, investing in technology.

When Buffett took control of Geico in 1996, he increased its marketing budget. It wiped out nearly all of Geico’s revenue from a GAAP accounting perspective, but Buffett is confident that increasing advertising spending today will lead to more profitable customers tomorrow. And this is it: Under Buffett’s leadership, Geico’s market share grew from less than 3% in 1996 to 12% in 2020, and it went from No. 7 auto insurer to the #2 auto insurer, behind only State Farm.

So far, so good—but while Geico is investing in marketing, its rival Progressive is investing in technology. Founded only a year after Geico, Progressive began upgrading its IT systems in the late 1970s. In the 1980s, it bought its agents’ computers and sent them floppy discs to better match price to risk. In 1996, Progressive became the first auto insurer to allow consumers to buy insurance online, and it continues to streamline its backend systems so it can accurately quote new business. Today, Progressive boasts that it has ten billion price points and that its tech stack allows the company to adjust its rates faster than its competition—roughly once every business day. “We’re a tech company that happens to sell insurance,” is one of Progressive’s internal mantras.

Driving the company’s tech investment is an insight that probably goes beyond Buffett’s marketing acumen. Thanks to its agent-free, commission-free model, Geico enjoys a six percentage point cost advantage over Progressive in its operating costs. Since half of its business is through insurance agents, Progressive is unlikely to make it here. But Progressive CEO Peter Lewis, who led the company from 1965 to 2000, understood that an auto insurer’s biggest cost center was the claims it had to pay policyholders—four to five times larger, in fact, than its administrative and advertising costs. If Progressive can manage these “loss costs” better than the competition, Lewis argued, then it could become the de facto low-cost auto insurer.

The key to managing loss costs is technology in all its glorious variety. Back-end headquarters systems that can parse price and risk for each driver are important, but so are front line innovations like Snapshot, a shoebox-sized tool that in the 1990s Progressive began installing in the cars of willing customers. Snapshot, now an app on your mobile phone, tracks customer driving behavior; more than one in three Progressive customers who buy insurance directly from the company opt for “usage-based” premiums. Thanks to Snapshot and other innovations, Progressive simply knows more about its drivers than any other insurer, and it creates a virtuous circle where the company knows what to reward with discounts, to punish with surcharges, and what to completely clean up.

So, while Progressive’s operating costs have historically been six points worse than Geico’s, its loss costs have been 11 points better, meaning that Geico’s low-cost moat has been breached by technology. In contrast to Progressive’s streamlined system, Geico has more than 600 legacy IT systems. It didn’t start working on a Snapshot-like product until 2019, twenty years after Progressive started.

Buffett likes to say that when the water recedes, you see who’s swimming naked, and COVID is the perfect storm to reveal how little Geico cares about its digital wardrobe. During COVID, people suddenly stopped driving, and then, when the pandemic ended, they drove more than before and more carelessly than before. At the same time, the worst inflation in forty years hit all sectors of the economy, including auto-repair shops. Such rapidly changing conditions favor insurers with robust tracking tools, such as Progressive, and penalize insurers without them, such as Geico. Since 2020, Progressive has nearly doubled the number of personal auto policies—but Geico has lost nearly 15% of its personal insurance base. Progressive, not Geico, is now the number two auto insurer in the country.

It is noted that although lizard tagging is important, it is not as powerful as using sophisticated digital tools. Geico is a good example of what happens when a company, even a strong one, fails to reinvest in its future. Instead of a virtuous cycle—tech investments leading to better prices and better products, which drive more profits, which can then be reinvested to continue the cycle—Geico seems to be caught in the same vicious cycle that hurts. General MotorsMacy’s and other legacy companies.