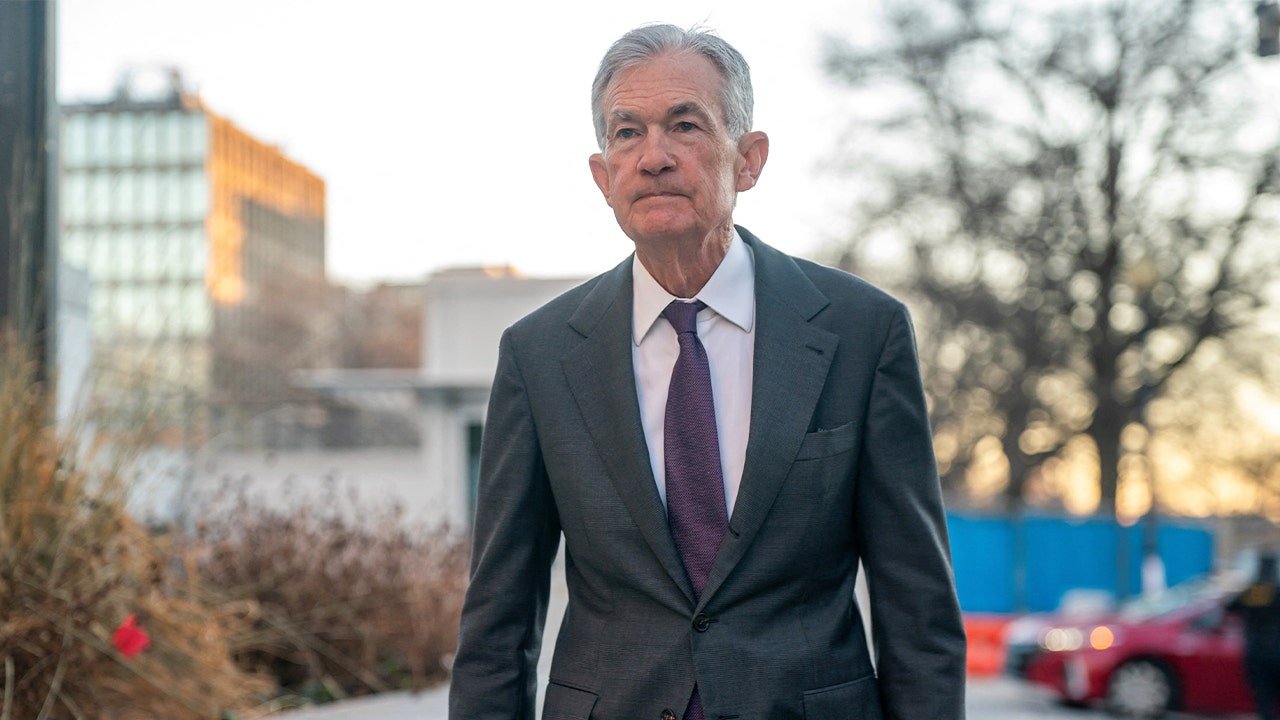

FOX Business White House Correspondent Edward Lawrence reports the Federal Reserve announcing its decision to leave rates unchanged in Making Money.

President of the Federal Reserve Jerome Powell said policymakers are hearing that a significant segment of American consumers are still looking to “economize” their purchases and trade down as they feel the effects of stubborn inflation on their household budgets.

Powell spoke at a news conference on Wednesday after the central bank left interest rates unchanged in January following consecutive 25 basis point cuts in The Federal Reserve three meetings to end in 2025.

The president was asked about data that suggests the cost of living remains at the top of concerns for American households and how there is a distinction between wealthier consumers driving the economy and less wealthy households struggling to get by.

“There’s something to the fact that we know that higher-income households that tend to own real estate and tend to own stocks, stocks, and those assets have been increasing in value and increases in wealth support spending over time, so that’s clearly part of the story,” Powell said.

THE FED KEEPS INTEREST RATES STABLE, PAUSES RATE CUTTING BECAUSE OF TOO MUCH ECONOMIC UNCERTAINTY

Federal Reserve Chairman Jerome Powell said returning inflation to 2% is the best way the central bank can help consumers. (Nathan Howard/Reuters)

“We also know that for some time, for a year or more, we’ve had news of retailers, for example, serving customers with lower incomes, Whether it’s food or big box stores or whatever, they all say the same thing, which is that our consumers are looking to save,” Powell said.

“They’re trading with the brands, and they’re buying less, and that’s it changing their buying habitsand that kind of thing. This is a reality of what we are seeing. They are still consuming, but they feel it in a different way,” he added.

Powell also said the central bank frequently hears affordability issues when it talks to businesses of all sizes and to households, and that it is focused on bringing inflation back to Fed’s 2% target is the best way to address these concerns.

JEROME POWELL OFFERS ADVICE FOR NEXT FED CHAIR, ADDRESSES FUTURE AT CENTRAL BANK

Powell said the Fed has heard from businesses and households about consumers wanting to “economize” and “cut back” to save money. (Stephanie Keith/Bloomberg via Getty Images)

“I would say more broadly on accessibility, we have a wide network through the reserve banks and also through the Governing Council where we talk to small and large businesses and households,” he said.

“So we hear a lot about affordability, and we take that very seriously and we take that very seriously, because one of our jobs is price stability,” Powell said. “The best thing we can do for people who are feeling that pressure is to keep inflation under control and, frankly, finish the job of getting inflation back to 2%.”

The The Fed’s preferred inflation gaugethe personal consumption expenditure index (PCE), stood at 2.8% in November and rose from a low of 2.2% last April, according to data from the Commerce Department’s Bureau of Economic Analysis. Powell noted that estimates based on the latest consumer price index (CPI) inflation data suggest that overall PCE came in at 2.9% in December.

FORMER FED OFFICIALS, TREASURY SECRETARY DEFEND JEROME POWELL AGAINST TRUMP DOJ CRIMINAL PROBE

He attributed the increased rate of price growth to higher tariffs, which are taxes on imports Trump administration is using as part of its trading agenda.

“These high readings largely reflect inflation in the goods sector, which has been driven by effects of tariffs. Instead, disinflation appears to be continuing in the services sector,” the president noted in his opening remarks.

During the press conference, he added that the overcoming of inflation resulting from tariffs on imported goods is likely to be the result of a one-time increase in prices except for the imposition of new tariffs that could add to the price pressures faced by consumers.

GET THE FOX BUSINESS ANYWHERE CLICK HERE

“The expectation is that we’re going to see the effects of tariffs flowing through commodity prices peak and then start to taper off, assuming no significant tariff increases,” Powell told FOX Business’ Edward Lawrence. “That’s what we hope to see throughout this year.”