Ball Corporation (NYSE:PILOT) is included among the The 10 Most Profitable Undervalued Stocks to Buy

On February 5, 2026, Citi analyst Anthony Pettinari raised his price target on Ball Corporation from $67 to $74 and reiterated a buy rating, citing strong fourth-quarter results and what the company described as a compelling outlook for 2026 and 2027.

A day earlier, on February 4, 2026, a wave of analysts upgraded their views following Ball’s earnings release. Truist raised its price target to $75 from $69 and maintained a buy rating, noting that the roughly 9% move after earnings reflected growing investor confidence in execution and the company’s more focused approach to profitable growth under new CEO Ron Lewis. RBC Capital also raised its target to $74 from $67 and reiterated an outperform rating, citing a fourth-quarter earnings increase driven by robust volumes and continued strong execution.

BofA raised its price target to $71 from $63 and maintained a buy rating, while modestly raising its EPS forecasts for fiscal 2026 and 2027 after the quarter. UBS raised its target from $58 to $66 and maintained a neutral rating after updating its model following the earnings. Morgan Stanley raised its price target to $66 from $63 and maintained an Equal Weight rating, citing improved clarity on operating leverage in 2027, although near-term earnings revisions may be limited.

On February 3, 2026, Ball reported fourth-quarter revenue of $3.35 billion, ahead of the consensus estimate of $3.11 billion. Chief Executive Officer Ron Lewis said the company increased volume during the quarter and returned approximately $1.54 billion to shareholders through share buybacks and dividends.

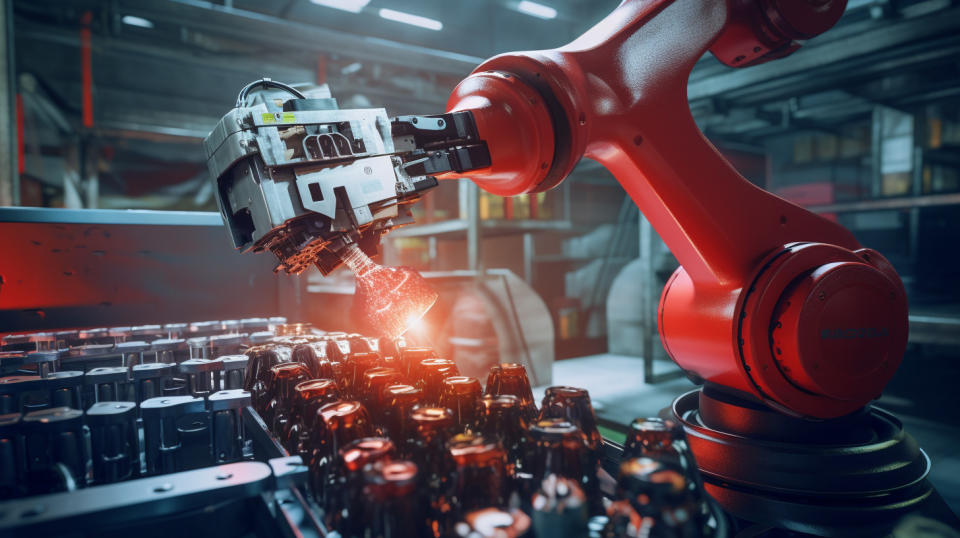

Ball Corporation (NYSE: BALL) supplies aluminum packaging products to the beverage, personal care and household products industries in the United States, Brazil and internationally. The company manufactures and sells aluminum beverage containers for filling carbonated soft drinks, beer, energy drinks and other beverages.

While we recognize BALL’s potential as an investment, we believe that certain AI stocks offer greater upside potential and less downside risk. If you’re looking for an extremely undervalued AI stock that will also benefit significantly from Trump-era tariffs and the onshoring trend, check out our free report on the best short term AI stock.

READ THE FOLLOWING: The 10 Most Profitable Undervalued Stocks to Buy i 12 Best Nuclear Power Stocks to Buy Now

Disclosure: no.