The world’s largest cryptocurrency rose to its lowest price since April. Bitcoin is down nearly 2% in the past 24 hours and hit a low of nearly $81,000 late Thursday night—well below its last floor of $82,175 in November. On Friday, the token posted a moderate rebound and is now trading at around $82,290, according to data from Binance. Bitcoin’s freefall has spread to other cryptocurrencies, including Ethereumwhich is down 4% in the last 24 hours to now around $2,660.

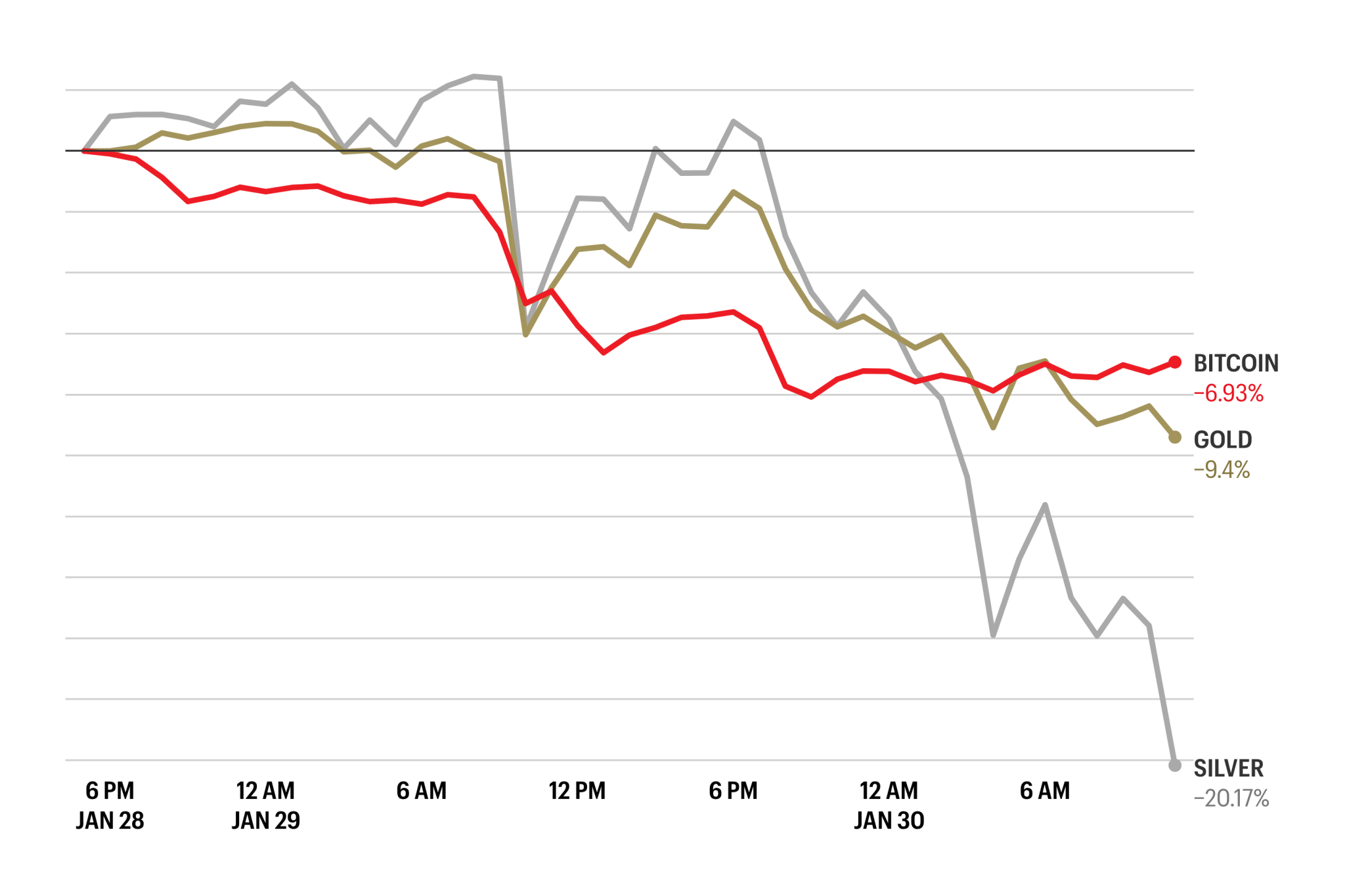

In the meantime, this week has seen an even worse drop in the price of precious metals, which so far has not produced a tear. Gold is down 11% on the previous day and silver is down an even bigger 31%. Platinum and copper are also low.

Volatility in crypto and metal markets comes as President Donald Trump announced Friday morning that he is nominating Kevin Warsh to replace Jerome Powell as chairman of the US Federal Reserve. It also comes as investors remain uneasy with Big Tech’s massive investment in AI. After the markets closed on Thursday, Microsoft reported strong earnings but its results failed to comfort investor concern of increased spending and slowing of revenue streams. The tech giant’s stock fell more than 10% in after-hours trading.

“Concerns about Big Tech’s heavy investment in AI, without the corresponding earnings to justify the spending, appear to be troubling broader risk assets,” said Matt Howells-Barby, a vice president at crypto exchange Kraken, in an email.

Jake Ostrovskis, head of OTC trading at market maker Wintermute, echoed Howells-Barby and said falling prices in Microsoft’s stock and gold are “starting to move lower risk.”

Bitcoin’s price decline continues to flag the cryptocurrency since October, when new tariff threats from Trump preceded a “flash crash“in the crypto market. The world’s largest cryptocurrency has historically tracked tech stocks, but Bitcoin and the S&P 500 have diverged over the past three months. Bitcoin is down more than 30% since early October, while the S&P 500 is up nearly 3%.

The flagging of token prices has prompted some analysts to say that the crypto market, which hit an all-time high in 2025, has turned bearish. However, institutional interest in stablecoins and new crypto regulation has others cautiously optimistic. “This is a mild Crypto Winter,” said Alex Kuptsikevich, chief market analyst at forex broker FxPro, in a recent research note.