When Microsoft CEO Satya Nadella told employees in October that he was stepping down from running the tech company’s commercial businesses, saying he was doing so to increase his focus on technology work at Microsoft — and AI in particular. Nadella explained that Microsoft’s continued success will depend on equipping customers with new artificial intelligence capabilities to make it the “partner of choice for AI innovation.”

Along with that act, the 58-year-old Microsoft chief, whose 12 years in the corner office was an eternity in Fortune 500 standards, is telegraphing that AI mastery is non-negotiable. During Nadella’s time extremely successful runshares rose 11-fold and Microsoft joined a very small club of companies with valuations above $3 trillion. But he won’t stay relevant or effective if he doesn’t stay on top of AI and how it’s changing his industry—and even then, his peers in any industry.

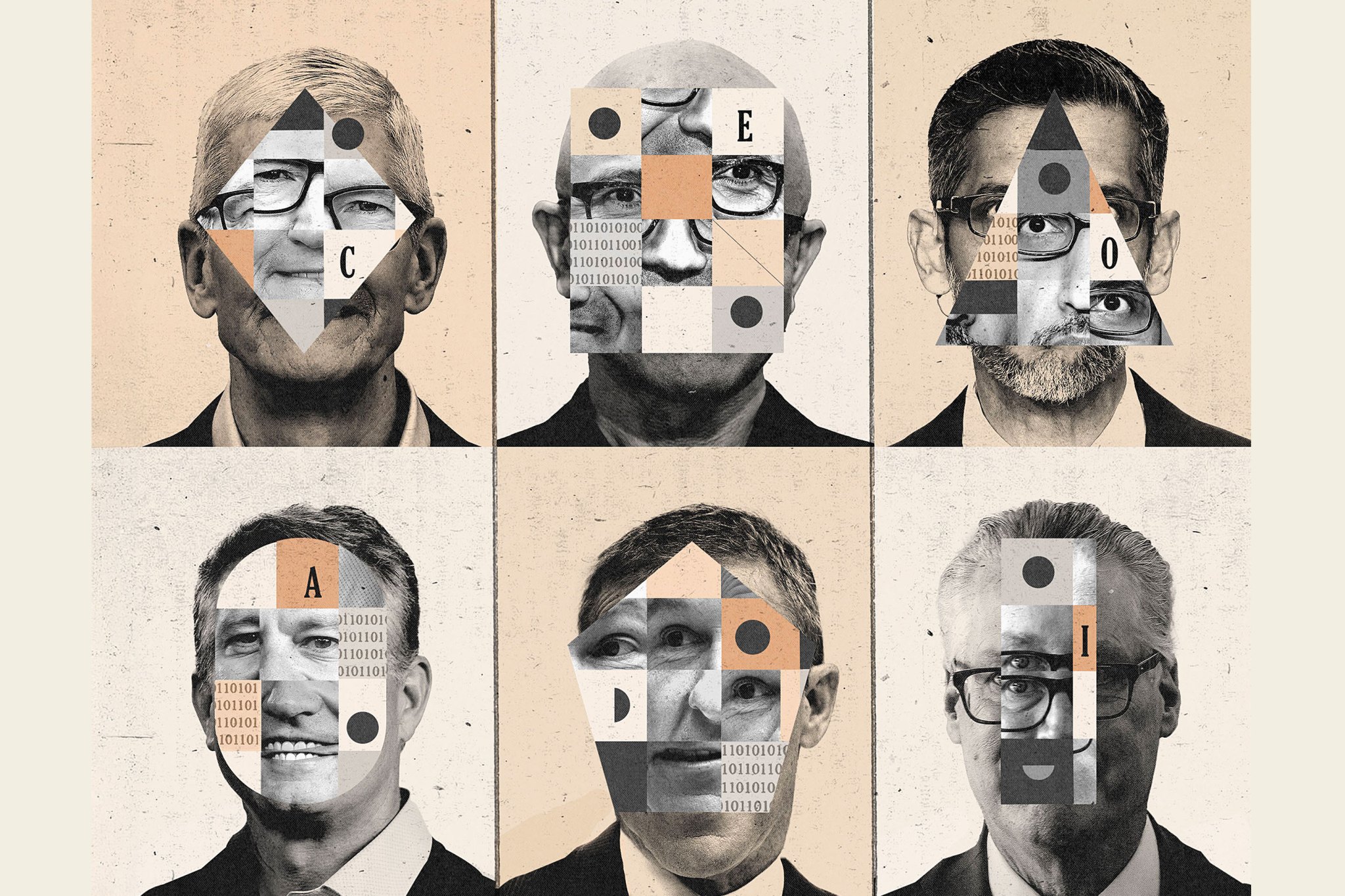

This new reality is taking shape as many of Silicon Valley’s most high-profile CEOs are extending their tenures into their second decades. They include 53-year-old Sundar Pichai (10 years in Googlesix titles of its recently formed parent, Alphabet), and the 65-year-old Apple Tim Cook (14 years as CEO). It’s becoming increasingly clear that AI will play a major role in how long these CEOs stay on top.

But elsewhere in tech, and across the Fortune 500, such long tenures are likely to become more rare—at least in the first waves of the AI boom. In fact, the numbers have started to decrease. The average global CEO tenure decreased to 7.2 years, below the high of 8.4 years recorded in 2021 and 2023, according to leadership advisory firm Russell Reynolds. (Tech CEO tenures are roughly in line with the cross-industry average.) And that number will likely continue to drift downward for several years. The company estimates that’s because boards closely monitor the effectiveness of the CEO and if they respond to change with precision and adaptability, considerations prioritized by AI. And those boards move faster when the show is delayed.

“What we’re seeing across the board is a desire for CEOs who bring more of an innovator’s mindset and adaptability.”

Jason Baumgarten, Partner, Spencer Stuart

In addition to creating more churn, the broader adoption of AI could also shake up the demographics of the CEO pool. Industry observers expect the next wave of younger CEOsas boards seek leaders who are fluent in AI. And CEOs may also need youth—or at least youth—to help prevent burnout as AI produces faster change within their companies.

“Between the compression of the disruption cycle and the inherent risk, the board’s expectation for CEOs is that you have to be a native AI,” said Chad Hesters, CEO of executive search firm Boyden. “You have to understand these things, and you have to understand that this is not a gradual transition.”

It’s no coincidence that the longevity and success of AI has gone hand in hand with Big Tech. Nadella, who comes from a product background, blazes a trail and shows other long-term CEOs how to recognize and approach the rise of AI: Microsoft’s early investment in OpenAI, and its integration with ChatGPT in the Azure Cloud business, are hallmarks of his management.

Pichai, on the other hand, returned to Google from a laggard in generative AI a major threat to ChatGPTby OpenAI CEO Sam Altman’s own admission. Pichai committed the company to an “AI-first” strategy, putting machine learning at the center of Google’s products, research, and infrastructure and ensuring that AI is not an afterthought.

When it comes to Applemany critics say that under Cook, it has falling behind the AI race. Several senior leaders are leaving the company in the fourth quarter of 2025, and there is much speculation that Cook may be preparing to leave. (Apple declined to comment on reports of that speculation.)

Short horizons

The rise of AI has coincided with shrinking CEO duties, as leaders race to adapt.

7.2 years

Average tenure of current CEOs in 2025, down 14% from 2023

15.8 years

Average tenure of Magnificent Seven CEOs, as of December 2025

306

Number of S&P 500 earnings calls in Q4 2025 where AI was mentioned

Source: Russell Reynolds, Factset

Although elder statesmen by relatively young technological standards, Nadella and Pichai have figured out how to navigate a technology that is changing how business is done. It’s not about pure AI skills that a computer scientist might have, but about AI savvy and understanding how AI can help them, and the companies they lead, to compete.

After all, the job of a tech CEO is hardly focused on coding and the technical minutiae of AI, or any other technology for that matter, but rather on taking the big picture view and designing and implementing strategy. The work also calls for the perspective that comes with experience, to better understand the nuances of the changes that AI can bring about in other elements of a business, such as data privacy and security.

However, the urgency of CEOs needing AI-based insights is hardly limited to technology companies. In fact, every industry needs to be transformed by AI. In retail, AI will radically change business pillars such as customer surveys and inventory management, while airlines will use it for important tasks such as optimally scheduling flights in the event of a dramatic snowstorm, or predicting aircraft component failures.

When Walmart and Batas each recently introduced new CEOs- John Furner and Michael Fiddelke, respectively- both retailers touting the convenience of future AI bosses, a technology that is already changing how their customers shop. (Walmart recently moved its stock listing from the NYSE to the Nasdaq(not to mistake its tech focus.) In aviation, Ed Bastian of Delta Air Lines earlier this year unveiled a generative-AI travel assistant, while Scott of United Airlines Kirby Admitted in June that his plane “probably does more AI than anybody.”

The companies certainly believe investors care: A FactSet report in December found that in the most recent quarterly earnings period, the term “AI” was cited in 306 earnings calls made by S&P 500 companies, above the five-year average of 136.

That said, older tech and legacy industry CEOs don’t need to worry if they lack the time or ability to become AI insiders. They can survive, and even thrive, in the AI wave as long as they show intellectual curiosity and adaptability, says Jason Baumgarten, a partner at leadership advisory firm Spencer Stuart, who helps train CEOs and advises boards.

“What we’re seeing across the board is a desire for CEOs to bring more of an innovation and adaptability mindset, and not a strict push for ‘the way it used to be,'” Baumgarten said.

More than ever, CEOs need to think ahead to what their industry and their clients’ needs will look like in the long term. “You can’t just ‘CEO’ your way through this and just hand it over,” says Fawad Bajwa, global AI, analytics, and data practice leader for Russell Reynolds. “You need to manage what it means, in terms of possibilities and constraints and potential risks.”

In an echo of the bubble of the 1990s, when people understood that the internet could change lives but didn’t quite know how or how fast, near-term expectations probably exceeded the reality of what AI would eventually deliver. In fact the stock market has been volatile lately, as investors try to determine if companies are spending too much on AI in a short period of time.

That’s why CEOs need to be careful not to get carried away by the hype, and avoid betting on initiatives whose utility is unclear. “You’re accountable for delivering an ROI,” says Boyden’s Hesters.

That’s proven difficult so far: Indeed, the growing complexity of identifying where AI can make an impact has helped fuel a recent surge in the number of companies opting for co-CEO arrangements, says Christine Barton, a managing director and senior partner at Boston Consulting Group who heads his North American CEO advisory practice. “It’s a difficult set of skills for an individual to have,” Barton said. “Even if individuals have mastered the ability to integrate skills, are they really optimizing these different parts of the brain?” In a related development, many companies are making their CTOs and CIOs more central to the creation of overall corporate strategy by the rest of the C-suite.

It’s not just Fortune 500 CEOs who need to show ease and agility in dealing with the AI revolution. Jeff Clavier, cofounder and board member of venture capital firm Uncork Capital, says he asks the CEOs of his portfolio startups to imagine what a fully AI-enabled version of their company and industry would look like—because, he told them, for every one of their companies there are another 10 startups preparing for AI.

“The key trait for CEOs in an AI world is the ability to accept that fundamental changes will happen way, way faster than typical change curves,” Clavier said. He pointed out how ChatGPT, in more than three years of age, has changed a lot. Every leader must accept the possibility that they will need to completely reinvent their business, in short order and often, in the age of AI—in other words, to channel their inner Satya Nadella.

This article appears in the February/March 2026 issue of luck with the headline “AI is changing the CEO’s role—and could lead to a changing of the guard.”