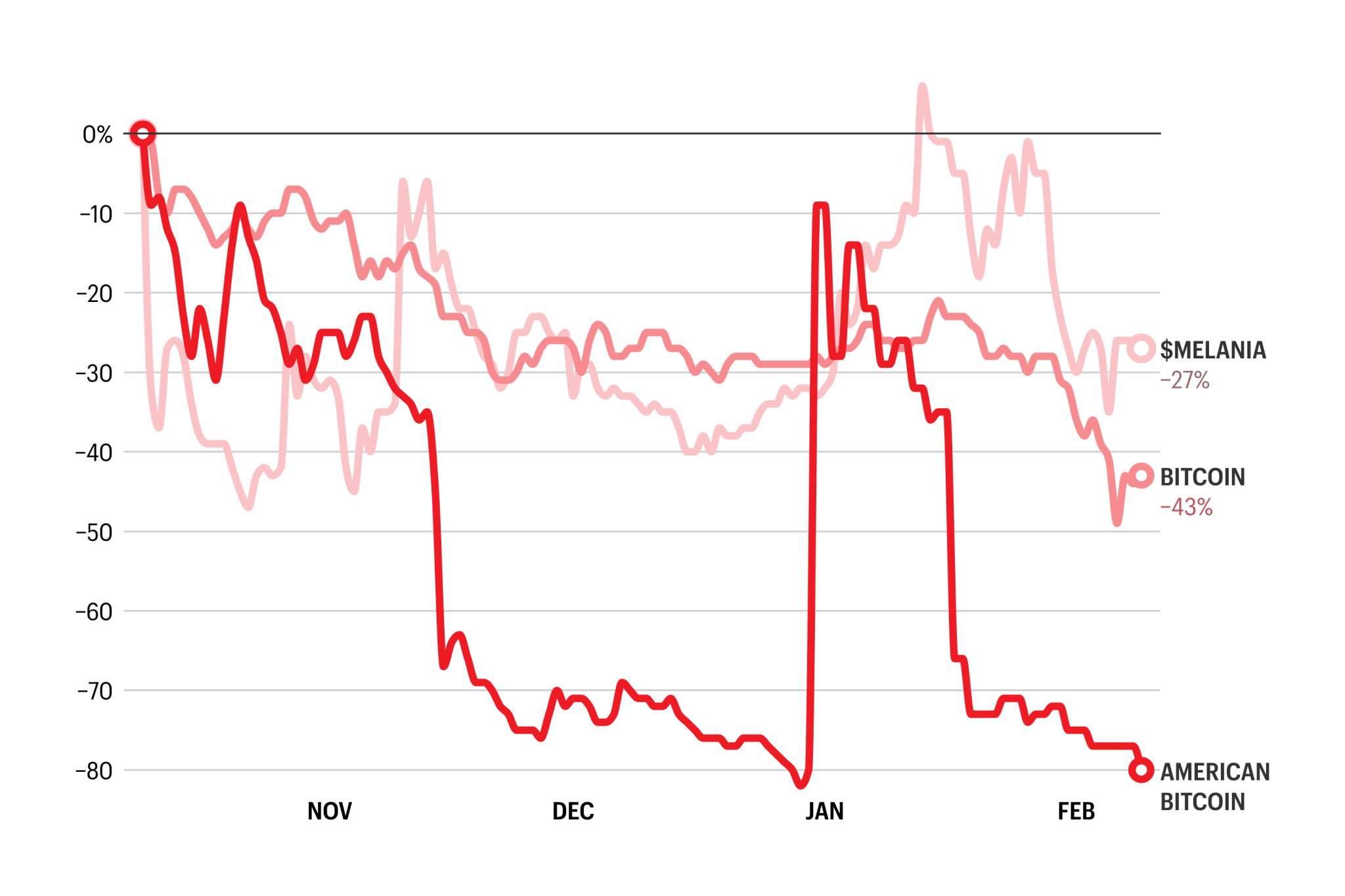

The crypto wipeout that evaporated $1 trillion in market value over the past three months has hurt all corners of the industry—including many crypto ventures linked to President Donald Trump’s family. But while the family’s portfolio is down across the board, some assets have been hit harder than others.

Since October 10, when the crypto market witnessed the so-called “flash crash,” the worst performing crypto asset tied to the Trump family was American Bitcoin stock Bitcoin mining and holding stable—backed by the President’s two sons, Eric and Donald Jr. —decreased more than the world’s largest cryptocurrency and plunged about 80%. Its market capitalization is more than $1 billion. That’s a far cry from its high of nearly $8.5 billion when the company first went public in September.

The best-performing Trump-tied crypto asset after the digital assets market cratered in October was the First Lady’s memcoin, $MELANIA. The token decreased by only 27% and experienced an increase before the release of Melania Trump’s documentary in late January. However, the cryptocurrency has dropped more than 98% since its launch a day before President Trump’s inauguration last year.

The drop in the price of the Trump family’s crypto holdings is no different than the recent drop in value of hundreds of other cryptocurrencies in what was once a very volatile market. But the fluctuations in the Trump family’s crypto holdings are significant because, over the past year, so much of the family’s wealth has been tied up in the blockchain industry. (Fortune has a breakdown of the main pillars of the Trump family’s crypto holdings HERE)

Historically, the Trumps have made their money from real estate. Estimates now vary, but, as of early January, luck values the Trump family’s crypto holdings at about $3 billion. That includes stakes in public companies: American Bitcoin, the crypto hoarder ALT5 Sigmaas well as Trump Media & Technology Groupa social media company that has bought nearly $1 billion in the world’s largest cryptocurrency.

There are also three cryptocurrencies: Melania’s memecoin, the President memecoinand a cryptocurrency launched by Financial World Libertya crypto business founded by the President’s children.

The recent crash in the digital asset market may prompt observers to question whether the Trump family’s portfolio of digital assets is built to withstand market gyrations over the long term. However, paper gains or losses may be beside the point. The Trumps have cashed out—in actual dollars—at least $1.2 billion from World Liberty Financial, possibly their most lucrative Trump crypto venture, in the past 16 months, according to recent analysis from Wall Street Journal.

A spokeswoman for World Liberty Financial declined to comment.