Federal Reserve Governor Stephen Miran discusses the direction of economic policy after President Donald Trump tapped Kevin Warsh to lead the Federal Reserve on “Mornings with Mary.”

Federal Reserve Governor Stephen Miran called on Tuesday for the central bank to make aggressive interest rate cuts this year.

“I’m probably looking at a little more than a point of interest rate cuts over the course of the year,” Miran told FOX Business Network’s Maria Bartiromo on “Mornings with Maria.”

Miran, along with Fed Governor Christopher Waller, was a dissenter at the last meeting of the Federal Open Market Committee (FOMC) on January 28. In a 10-2 vote, the central bank left rates unchanged in their current range of 3.5% to 3.75% after three successive 25-basis-point cuts in September, October and December. Miran and Waller were in favor of a quarter stitch cut.

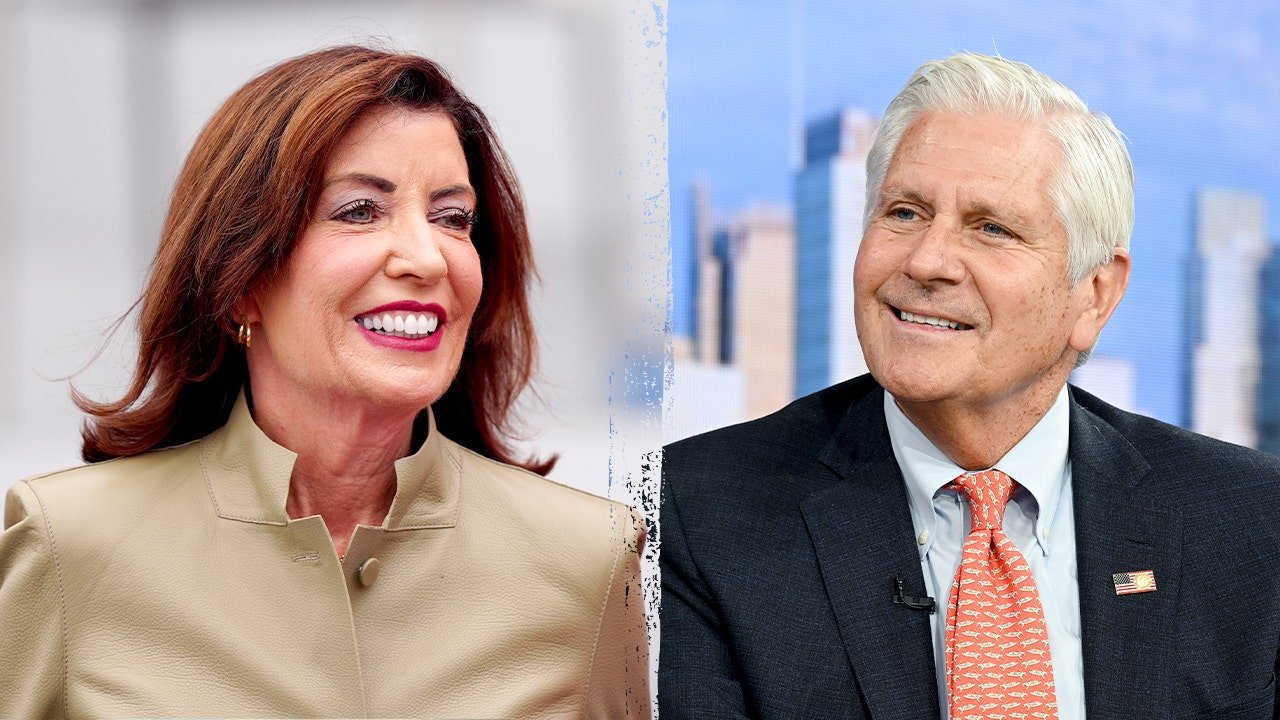

Stephen Miran, chairman of the Council of Economic Advisers, after a television interview outside the White House in Washington, DC, US, Tuesday, June 17, 2025. (Getty Images)

THE FED KEEPS INTEREST RATES STABLE, PAUSES RATE CUTTING BECAUSE OF TOO MUCH ECONOMIC UNCERTAINTY

Miran has supported deeper cuts than the FOMC has favored since joining the board while stepping down from his role at Trump administration. His term at the Fed technically expired on January 31, although he can remain in his role as governor until his successor is confirmed.

Waller last dissented from an FOMC decision in July, when the Fed held rates steady and was seen as a contender for the Fed chairman’s nomination ahead of President Donald Trump. appointed former Fed Governor Kevin Warsh to run the central bank. Warsh may fill the vacancy created by the expiration of Miran’s term.

Former US Federal Reserve Governor Kevin Warsh speaks during the annual conference of the American Economic Association (AEA) in Chicago, Illinois, US on January 6, 2017. (Daniel Acker/Bloomberg via Getty Images)

FED GOVERNOR SAYS CURRENT ECONOMY ‘REQUIRES LARGE INTEREST RATE DELAYS’ TO HELP LABOR MARKET

While the market currently sees two 25-basis-point rate cuts as the most likely outcome this year according to the CME FedWach tool, Miran said he believes 100 basis points of cuts are needed this year.

“When I look core inflation, I don’t see many imbalances between supply and demand of the kind that monetary policy should respond to. So I think we’re keeping rates too high, mostly because of the quirks of how we measure inflation rather than actual price pressures,” he added.

JEROME POWELL OFFERS ADVICE FOR NEXT FED CHAIR, ADDRESSES HIS FUTURE AT CENTRAL BANK

Asked about Atlanta Fed President Raphael Bostic suggesting interest rates may not need to be cut this year, Miran said the Fed has a “very strong diversity of opinion.”

Federal Reserve Governor Stephen Miran at the Semaphore World Economic Summit during the fall meetings of the International Monetary Fund and the World Bank in Washington on October 16, 2025. (Pete Kiehart/Bloomberg/Getty Images)

“I think we’re being misled by the quirks of how we calculate inflation rather than the actual price pressures in the economy. I think that’s leading us to leave our target fed funds rate too high,” he said. “Everyone has an opinion. At the end of the day we’re a committee and we take votes. I’m just one member of that committee, but I’ll continue to defend my point of view because I think it’s right.”

Asked about Warsh’s nomination to lead the central bank, Miran told Bartiromo that “I think Kevin Warsh is a great choice for Fed chairman.”

GET THE FOX BUSINESS ANYWHERE CLICK HERE

He went on to say that Warsh is well-respected by Wall Street, the investment community and policymakers, adding that “I’m very excited to see the things he’s going to do with the Federal Reserve.”