Kevin Warsh is truly the best man for the job at the Federal Reserve. President Trump has made an excellent decision. The brilliant and popular Kevin Hassett will continue as director of the National Economic Council. And the wise Scott Bessent will stay at the Treasury. This is a very strong economic team that is expected to fuel the supply-side productivity boom that has already begun to emerge from the One, Big, Beautiful Bill legislation authored by Mr. Trump, and signed by him on July 4, 2025.

Warsh has already had a long run at the Fed. He knows where the bodies are buried and which economic models must be eliminated. He has a great opportunity to be a transformative figure in Fed history. Mr. Warsh knows that rapid economic growth and more people working do not cause inflation.

In numerous op-eds, he has correctly specified that excessive government spending and money printing cause inflation and high interest rates.

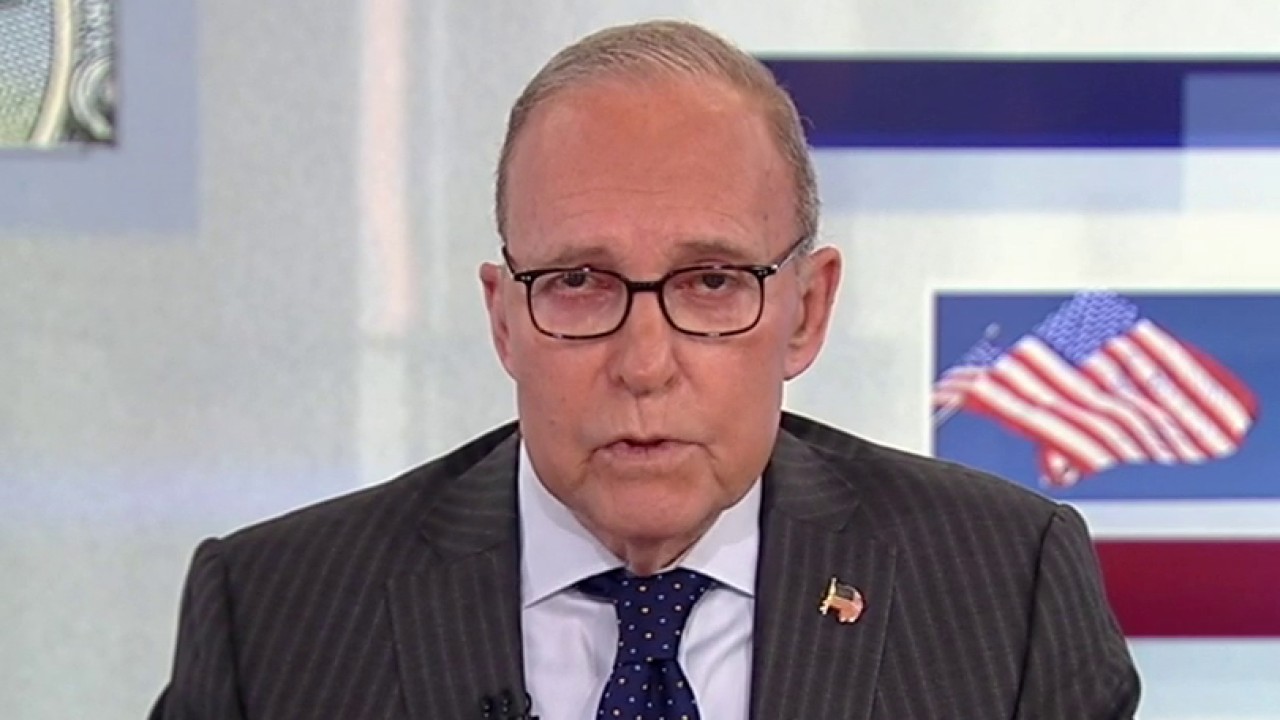

As he said in an interview with me on July 7 of last year: “So my simple version of this is run the printing press a little less, let the balance sheet go down, let Secretary Bessent handle the fiscal accounts, and by doing that you can have materially lower interest rates.”

Former Federal Reserve Governor Kevin Warsh discusses Fed Chairman Jerome Powell’s interest rate strategy on “Kudlow.”

I think Mr. Warsh understands that that the Federal Reserve’s bloated bond portfolio has in fact financed socialism and big government inflation, which in turn has led to sclerotic economic growth and excessively high interest rates. He knows it. He has said it many times.

And he’s an astute analyst of overpriced market price signals and commodity trends that can serve as early warning signs of inflation. It has also always subscribed to a solid and stable “King Dollar”. It must also transform and resurrect the independence of the Fed. No more greening of the financial system, no climate change, no diversity, equity and inclusion policies. They are leftist fads that are now gone and should never return to a monetary institution.

Mr. Warsh is a capable administrator from his earlier years as Fed governor. And you can bet it will clamp down on insider trading compliance, in a way that Jerome Powell ignored. Warsh is likely to leave trade and tariff policies to the Trump administration, just as he is more than willing to leave debt management policies to the Treasury Department. In short, it will return the Fed to its former, narrower mission in order to make it more effective.

Mr. Warsh is the right man for the job. He is also the right man for a new Golden Age in the American economy.